👶 Family & Dependents

Child Tax Credit (CTC) – Helps families with qualifying children; up to ~$2,200 per child.

Additional Child Tax Credit (ACTC) – Refundable portion of the CTC (up to ~$1,700 per child).

Earned Income Tax Credit (EITC) – Refundable credit for low- to moderate-income workers; amount varies by income and family size (~$649–$8,046).

Child and Dependent Care Tax Credit (CDCTC) – For work-related care expenses for qualifying children/dependents; nonrefundable.

Other Dependent Credit – For dependents not eligible for CTC, such as older children or elderly relatives.

👶 Adoption & Education

Adoption Tax Credit – Up to ~$17,280 per eligible child for qualified adoption expenses; partially refundable.

American Opportunity Tax Credit (AOTC) – Up to $2,500 for college expenses (first 4 years); up to $1,000 may be refundable.

Lifetime Learning Credit (LLC) – Up to $2,000 for undergraduate/graduate or non-degree education.

💰 Work & Retirement

Saver’s Credit – Up to $1,000 (single) / $2,000 (joint) for eligible retirement plan contributions.

🏡 Energy & Property (2025 Deadlines)

Many energy-related credits are still available in 2025 but may expire at year-end under current law:

Residential Clean Energy Credit – ~30% of qualified solar, wind, geothermal systems installed before Dec. 31, 2025.

Energy Efficient Home Improvement Credit – Up to ~$3,200 for energy-saving home upgrades (windows, doors, heat pumps, etc., for 2025 installs).

🔁 Other Credits

Premium Tax Credit – Refundable credit for health coverage purchased through the Marketplace.

Fuel Tax Credit – For certain business or farm fuel use (rare for individuals).

🚫 Credits Ending or Changing in 2025

Electric Vehicle (EV) Tax Credit — new/used EV credits sunset Sept 30, 2025 under current law; no credit thereafter

🟦 Overtime Deduction

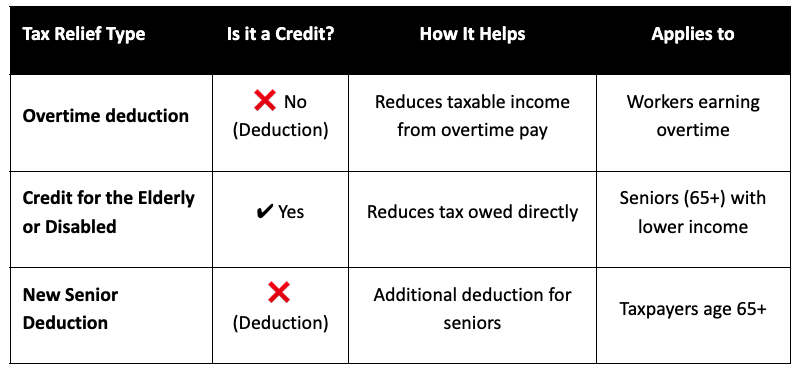

There isn’t currently a specific tax credit for overtime, but there is a new federal tax deduction that can significantly reduce your taxable income if you earn overtime pay:

What it does: Allows you to deduct the premium portion of overtime pay (the “extra” above your regular overtime rate — for example, the half-time portion in time-and-a-half pay) from federal taxable income.

Maximum amounts:

• Up to $12,500 deduction for single filers.

• Up to $25,000 for married couples filing jointly.Income limits: Phases out at modified adjusted gross income (MAGI) above $150,000 (single) and $300,000 (joint).

Eligible overtime: Must meet the Fair Labor Standards Act definition (hours over 40/week at time-and-a-half).

Key point: This is a deduction, not a refundable tax credit — it reduces the income on which tax is calculated, rather than directly reducing tax owed.

So while not a credit, it’s one of the biggest ways overtime earners can reduce their federal income tax liability for 2025.

🧓 Seniors — Tax Relief for Age 65 +

There is an actual tax credit for some older taxpayers, plus a new substantial deduction:

✅ Credit for the Elderly or the Disabled

Who qualifies: Individuals 65 or older (or permanently and totally disabled) with income below certain limits.

Amount: The credit ranges roughly from $3,750 to $7,500, depending on filing status and income.

How to claim: Use Schedule R (Form 1040 or 1040-SR) when filing.

Important: This is a true credit — it directly reduces tax owed rather than simply lowering taxable income.

This credit existed before 2025 and continues to be available if you meet the criteria.

📉 New Senior Deduction (2025–2028)

Extra standard deduction: Individuals 65 + may take a new additional $6,000 deduction, on top of the regular standard deduction.

Filing status limits: Applies whether you itemize or not.

Income phase-out: Begins phasing out above ~$75,000 (single) or ~$150,000 (joint).

Like the overtime rule, this is a deduction, not a direct credit — but it still lowers taxable income.

🧠 Quick Summary

🧾 Key Notes

The overtime “no tax” rule isn’t literally a full exemption — it’s a deduction that lowers taxable income but you still pay FICA/Social Security and possibly state tax.

The senior credit can be especially valuable if your income is below the IRS thresholds.

Both the overtime deduction and the enhanced senior deduction are temporary provisions through tax year 2028 under current law.