What Is the EITC?

The Earned Income Tax Credit (EITC) is a refundable federal tax credit designed to benefit low- to moderate-income workers and families. It can reduce the taxes you owe and increase your refund — even if you don’t owe any tax.

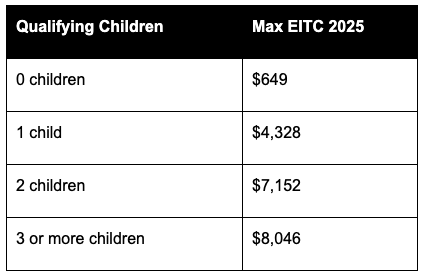

Maximum Credit Amounts (Tax Year 2025)

For the 2025 tax year (filed in 2026), the maximum EITC you may be eligible for depends on your number of qualifying children:

These amounts are adjusted annually for inflation.

Income Limits & Phase-Outs

Your earned income and adjusted gross income (AGI) must fall below specific thresholds to qualify. For 2025:

For Single / Head of Household Filers

0 children: AGI must be less than $19,104

1 child: AGI less than $50,434

2 children: AGI less than $57,310

3+ children: AGI less than $61,555

For Married Filing Jointly

0 children: AGI must be less than $26,214

1 child: AGI less than $57,554

2 children: AGI less than $64,430

3+ children: AGI less than $68,675

Other Key Eligibility Rules

Investment income cap: Your total investment income must be $11,950 or less in 2025.

You must have earned income (such as wages, salary, tips, or self-employment income).

If you claim children for the credit, each child must meet the IRS relationship, age, and residency tests and have a valid Social Security number (SSN).

For taxpayers without qualifying children, additional age and filing requirements usually apply (e.g., age 25–64). (Note: this age rule is from broader EITC guidance — check the IRS rules for specifics.)

Refund Timing

If you qualify for the EITC (or the Additional Child Tax Credit – ACTC), federal law generally delays issuance of refunds until mid-February 2026 (even if you file earlier), as the IRS must verify eligibility for these credits before sending them